Why Affirm?

Click on this link below to find How affirm payment plans work.

https://www.affirm.com/how-it-

Affirm is a Buy Now, Play Later (BNPL) financial services tool that allows consumers to purchase goods and services with full transparency and with no hidden fees that are associated with traditional loans. Other consumer benefits of using Affirm:

-

Quick and Easy

Checkout is simple at any store that accepts Affirm. Just enter a few pieces of information for a real-time decision. -

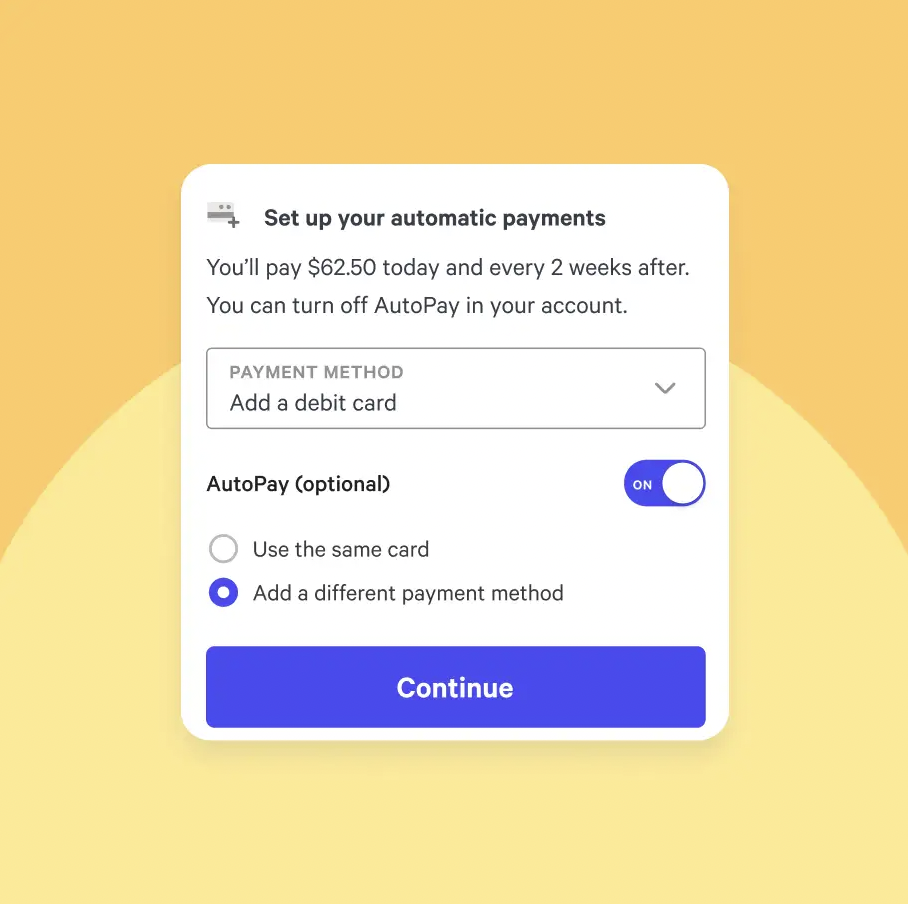

No Hidden Fees

Know up front exactly what you’ll owe, with no hidden costs and no surprises. -

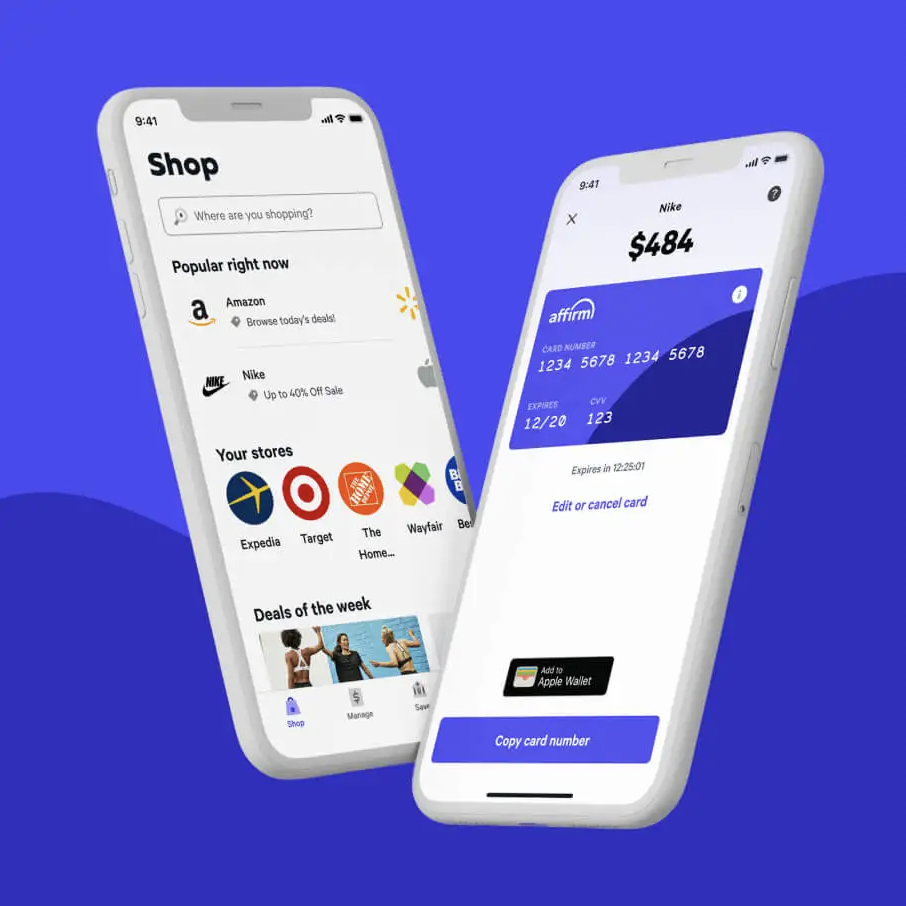

Safe & Secure

Affirm connects directly to online stores. There’s no card number to steal, so your account stays secure. -

You’re In Control

Pick a loan that fits your budget. You’ll make real progress every month, and at the end of your loan you’re free and clear.

We started Affirm because credit cards aren’t working. They lure us in with perks, but end up costing a lot: The average U.S. household has $6,000 in credit card debt.

With Affirm, you’ll never owe more than you agree to up front. Instead, you’ll always get a flexible, transparent, and convenient way to pay over time.

Affirm earns a commission from businesses, and shoppers pay interest on some items.

Unlike credit card companies though, we don't depend on shoppers paying late or staying in debt. Instead, we try to give them a great experience so they come back and use Affirm again.

How Affirm Works

Affirm has a number of products that help both merchants and their consumers. Those products and their nuances are covered elsewhere. Generally however, Affirm follows these steps:

-

Customer shops and orders product

Customer selects Affirm as a payment method.

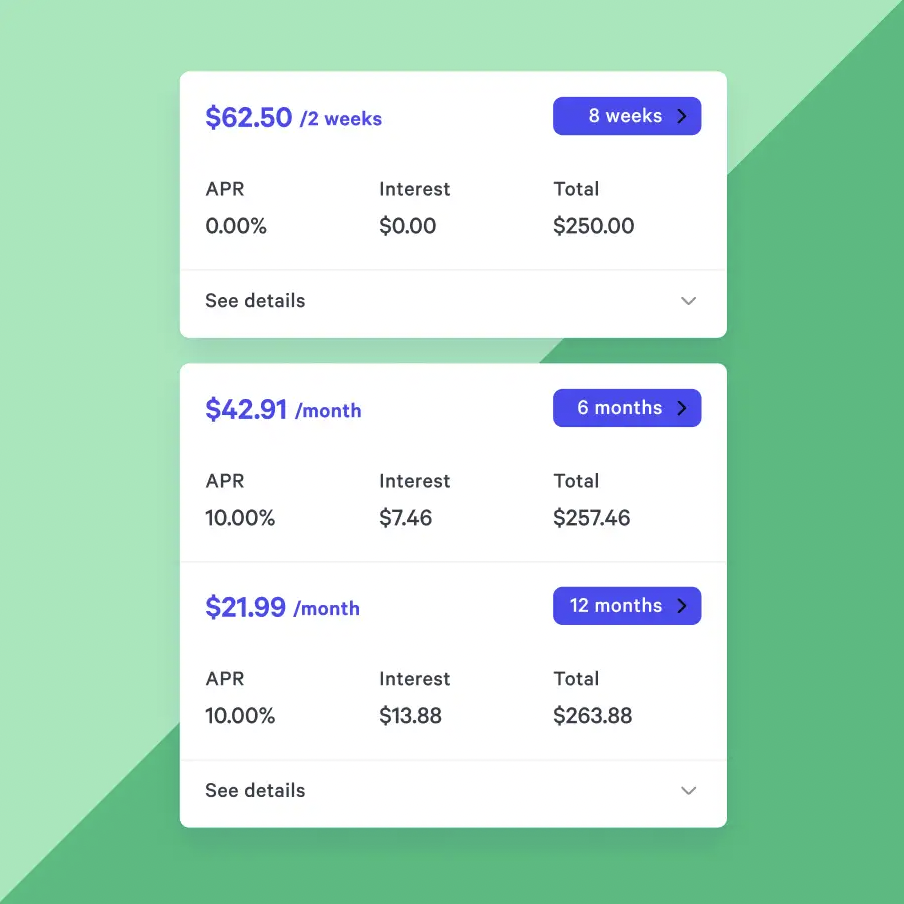

If they are eligible, then they select a loan that best works for them. They then complete the transaction.

-

Affirm Pays You, the Merchant

Merchant is paid in full (less fees and refunds) after capture on a 24hr rolling basis.

-

Customer Pays Affirm

Customer makes monthly or biweekly payments to Affirm for the duration of the loan.

-

Affirm Covers the Risk

Affirm assumes repayment/fraud risk and can easily issue full or partial refunds.